Illinois’ Gov. Quinn wants to make ‘temporary’ tax increases permanent

By Benjamin Yount | Illinois Watchdog

SPRINGFIELD, Ill. — Illinois Gov. Pat Quinn is telling taxpayers he cannot lie — he plans to keep Illinois’ “temporary” income tax increases.

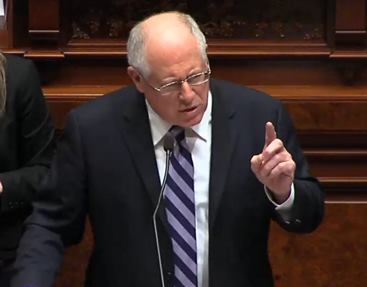

NOT ONE CENT LESS: Quinn says he needs to keep the temporary tax to spend more.

“I was elected in 2010 to be straight with the people of Illinois, and to be straight with you,” Quinn told lawmakers Wednesday at his budget address. “Today, I propose we take the path that is honest and responsible.”

That path is built on Quinn’s plan to make Illinois’ 2011 “temporary” income tax increases permanent.

Those tax hikes — one for residents and another for companies — will have raised $31 billion by the end of this year, and Quinn insists he needs that money.

“If action is not taken to stabilize our revenue code, extreme and radical cuts will be imposed on education and critical public services,” Quinn warned.

Of course, “stabilize our revenue code” are the code words for extend the tax increases.

Illinois lawmakers have proposed a budget that tops $34 billion, but doesn’t rely on the 2011 tax money. If Quinn gets his wish and a permanent tax hike, state spending could increase to almost $36 billion for the next year.

That would mean Illinois is spending $12 billion a year more than in 2000.

State budgets have risen steadily from just more than $24 billion in 2001 to nearly $36 billion last year. Yet Quinn said he wants to spend more.

“My blueprint invests $1.5 billion in birth to five (education),” Quinn said. “We also need to better fund our elementary and high schools … Over the next five years we will increase our investments in the classroom by over $6 billion.”

Quinn also wants to spend more on college scholarships, require a $10-an-hour minimum wage, and require paid sick time for even part-time workers. He’s not offering a price tag for that.

Republicans say now is not the time to look to spend more.

“Three years ago we (saw) a 67-percent income tax increase. The promise was to get the state in order, pay our bills and the rest,” state Rep. Darlene Senger, R-Naperville said. “None of those promises were kept.”

“The governor continues to persist in the belief and the claim that ‘But for high taxes, more spending, a higher backlog of bills there won’t be any prosperity in Illinois’,” state Sen. Dale Righter, R-Mattoon, said, emphasizing that he and the other GOP lawmakers will fight that claim.

That Quinn is asking to spend more isn’t a surprise. The governor has long supported the expansion of government programs, but as he heads toward a re-election fight in November, the promise of more money for schools and poor children is seen as election year politicking.

Christina Rasmussen, executive vice president of the Illinois Policy Institute, said just because Quinn is making those election year promises doesn’t mean he’ll keep them.

“When Gov. Quinn ran for office in 2010, he promised Illinois taxpayers he would not sign into law a tax increase above 1 percentage point, or 33 percent,” Rasmussen said. “A few months after the election, he signed Illinois’ largest tax increase in state history.”

Illinois lawmakers now will take Quinn’s ideas under advisement. The Legislature has until the end of May to craft a spending plan.

Contact Benjamin Yount at Ben@IllinoisWatchdog.org and find him on Twitter @BenYount.