Hannah Thoreson: ISIS Industry Not Likely To Have Major Impact On Oil Prices

Reports have recently surfaced claiming that the so-called Islamic State (ISIS) is making millions of dollars per day selling oil at below-market prices. However, the logistical challenges that ISIS faces in bringing a quality oil product to market are greater than they appear, and pose a significant enough burden that most of their oil is sold within local energy markets in the Middle East.

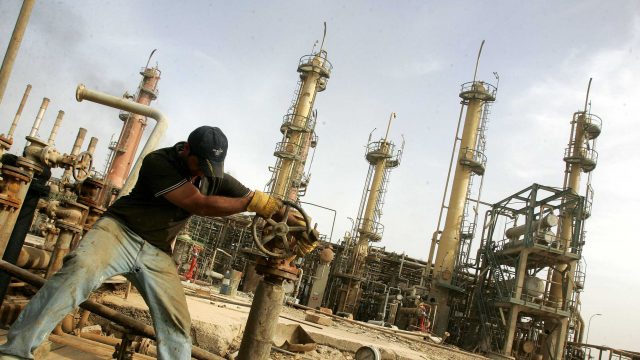

Problems begin at the wellhead. ISIS faces a variety of complications arising from its status as a war zone oil producer. Its production is similarly limited by what its forces can seize. From an energy producer’s standpoint, the fields that ISIS has taken in northern Iraq and Syria are marginal. It is in Southern Iraq is where the larger and more lucrative oil wells are located; and ISIS has not yet captured that territory from the Iraqi government. The remaining troubles for ISIS are as old as the oil industry itself.

The organizing problem for ISIS is the dearth of refining capacity in Iraq, and particularly in ISIS-controlled regions of the country. This limits what ISIS can do with the crude oil it obtains. Indicating the severity of the refinery shortage, in recent days ISIS and Iraqi Army forces have clashed over control of the country’s largest refinery. In the absence of sophisticated refining operations, it is reliant on mobile refining platforms that can only produce 300-1,000 barrels per day of poor quality fuel. Lacking the ability to transform larger quantities of crude into refined product hurts the profitability of its overall oil operations. Cross-border sales of its remaining crude must be used to purchase additional gasoline and refined products from neighbors.

The lack of available energy transit infrastructure is an equally significant burden. The technology ISIS employs to transport petroleum is extremely primitive. For example, the transit link it controls across the Iraqi border to Turkey consists of a plastic tube only a few inches underground. Without major pipeline infrastructure at its disposal, ISIS has taken a brute force approach. It moves heavy barrels of oil across the desert on the backs of human laborers, who physically carry ISIS’s oil on their shoulders.

Finally, ISIS also has a human resources challenge. It simply does not have the skilled engineers and technicians needed to manage an oil enterprise. This problem it has imposed on itself. The group’s terror tactics have prompted them to flee. The trademark violence of ISIS is not ideal for retaining the talented workforce it needs to refine oil.

These powerful upstream and midstream limitations should limit concerns that ISIS might soon leverage Iraq’s petroleum reserves to rival large International Oil Companies (IOCs) such as Royal Dutch/Shell or BP. The absence of skilled workers, basic infrastructure or more productive fields all serve as inhibiting factors. Nevertheless, where ISIS sell its remaining oil matters greatly.

The largest export market for black market oil sales by ISIS exists at the end of traditional smuggling routes to Turkey. Illicit transportation of oil across the border between Iraq and Turkey is not a new business. The involvement of ISIS in this age-old enterprise has, however, been a game changer for those involved. As ISIS expanded into the border region with Turkey, it established checkpoints and collected taxes on smuggled oil or other products shipped out of Iraq. The Islamic State also executes rival oil smugglers, thereby creating a local monopoly for its operatives. ISIS’s control of the oil smuggling channels into Turkey creates new channels for its other revenue generation streams, such as trafficking in human hostages.

Just as the routes into Turkey are important, so too are ISIS’s connections to Syria. In addition to being a supplier of energy to Bashir Assad’s regime in Syria, ISIS is simultaneously a geopolitical rival of the established Syrian government. Both exist in a symbiotic relationship revolving around energy extraction and consumption. Sanctions on Syria have created an environment where the Assad regime is reliant on oil that is either illegally smuggled into the country or pumped domestically. Both of those roles are generally filled by ISIS due to its captured oilfields in Syria and domination of trafficking networks throughout the region.

Ultimately, limited sales of crude can only go so far. While ISIS has found a lucrative way to use oil to fund the conquest of territory and sponsorship of a regional terror network, it remains to be seen whether its attempt at nation building in Iraq will be equally successful. Many of the challenges that ISIS now encounters are similar to the problems that the fledgling Iraqi government faced after the United States toppled Saddam Hussein. The more territory ISIS controls, the more expensive and difficult it becomes to provide basic services—such as electricity—to the people who live in a war zone.

Once significant difference between the previous Iraqi government and ISIS is that success in stabilizing its rule in Iraq only brings more pressure (not support) from the United States and foreign powers. The relative success of ISIS’ smuggling operation has drawn the attention of U.S. authorities, who plan to crack down on the group’s ability to integrate with legitimate businesses. The U.S. Treasury Department plans to freeze the assets of anyone caught moving the Islamic State’s oil. This is another reason that ISIS oil is unlikely to move into markets outside the black market cash economy of the Middle East.

Bigger is usually better in the oil world. This is not the case for ISIS. The low-hanging oil opportunities have already been exhausted or utilized. The more ISIS grows its oil operations, the harder they will be to sustain.