A Grand Idea For North Dakota's Legacy Fund

One of the chores North Dakota’s leaders are tasked with is what to do with the state’s Legacy Fund. Per a constitutional amendment approved by voters in 2010, since June of 2011 30% of the state’s oil/gas production/extraction taxes have been deposited in the fund.

The fund’s balance has soared past $700,000,000, putting it on track to far exceed the $860 million balance that was projected by June of 2013, and will soon be measured in the billions of dollars.

The question now is, what does the state do with all this money? We’ve locked it away, and provided strict guidelines for accessing it, but now what?

So far the fund has been invested very conservatively. An Associated Press report in May of last year noted that the fund was earning just 2.5% from investments mostly in short-term government bonds. But at some point, state leaders are going to be expected to do more with this money.

I can report to you that there is one idea that will be before this legislature that could allow the Legacy Fund truly live up to it’s name.

Here are the broad strokes:

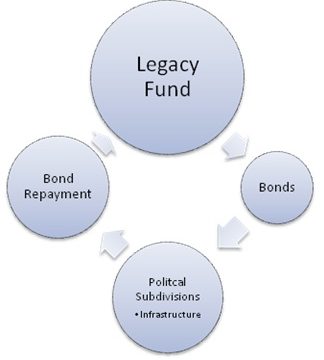

The Legacy Fund would be used to invest in North Dakota by securing bonds issued to the state and local governments for infrastructure projects. Right now, a lot of the infrastructure the state is building is being paid for up-front with tax revenues. This might make sense, most of us believe that avoiding debt is a positive, but anyone familiar with how a large business operates knows that there are advantages to financing large expenditures. Ask a rich person why they carry a home mortgage when they could have just bought it outright, and they’ll probably tell you that they got the interest rate they’re paying on the loan is lower than the return on investment they’re getting from putting that money which would have gone to the home purchase to work.

The Legacy Fund could work the same way for North Dakota. By bonding infrastructure through the Legacy Fund, the state could use the money saved in other ways. Such as for another sort of investment in the state’s future, tax relief.

If the state isn’t paying for all infrastructure projects up front, that means more revenues available in the near term for tax reductions. Rep. Scott Louser’s idea for a two-year suspension of the personal income tax is one idea. Lowering the state sales tax might be another idea.

But the investment in North Dakota would be two-fold. What better investment could the Legacy Fund possibly make than investing in our own state? What better use could there be for the Legacy Fund than to build a true legacy of infrastructure to facilitate the expansion of our state’s population and economy? What’s more, we’d be doing it in a way that also clears the path for tax relief by diminishing the up-front costs of that build out.

There are other advantages to this plan too. The state would essentially be doing its own financing. Meaning that if something happened which would make it difficult for a local government to pay back its bonds, such as flooding or other natural disasters, the state could help by modifying the terms of the bond.

There is no doubt that we are living in special times in this state. It is rare that a state has the opportunity to both invest in infrastructure and lighten the burden of taxation. Why not avail ourselves of that opportunity when we have the chance?

Again, there will be legislation before the legislation to put this in motion. You’ll be hearing more about this in the future, and there will be much debate about the specifics, but for now take this idea to heart. It’s a good one.

It’s what is right for North Dakota.