What North Dakota Democrats Aren't Telling You About Oil Tax Revenues

During the 2013 legislative session, when lawmakers were debating a proposal to eliminate triggers and exemptions in the state oil tax and replace them with a lower overall rate, Democrats rushed to the media with scary numbers about lost revenues.

But it turned out the numbers they were using were cooked. No doubt hoping that nobody would check their math, they were projecting state oil production to grow beyond 2 million barrels today. “Only one other model I’ve seen approaches such high volumes,” Lynn Helms, director of the Department of Mineral Resources, told me at the time. “The consensus models peak at 850,000 to 1,500,000 barrels per day total from all wells pre 2017 and post 2017.”

It seems Democrats were inflating oil production projections in their calculations in order to portray a bigger revenue hit from the tax reforms they oppose.

Now let’s come back to 2015. There’s another proposal to remove exemptions from the oil tax code in exchange for a lower, flatter tax rate and again Democrats are trotting out scary revenue projections. They’re literally calling this a “nightmare scenario.”

Using projected oil prices and oil production from sources including the Department of Mineral Resources and the U.S. Energy Information Administration, Democrats calculated a “best-guess scenario” of the long-term impact of lowering the oil extraction tax.

Under their projections, approving House Bill 1476 would result in a loss of more than $369 million in the 2015-17 biennium. The assumptions also say the state would lose another $5.8 billion in oil tax revenue through 2025.

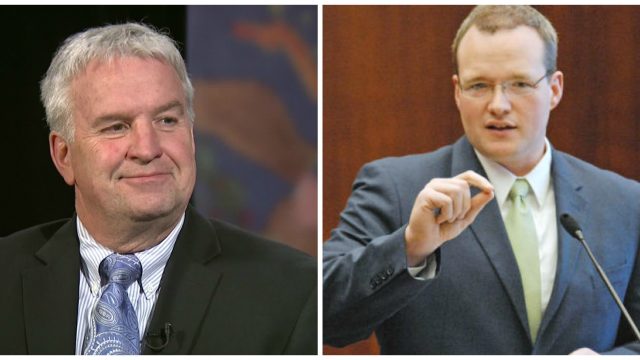

“This is best evidence of what is predicted to happen,” said Senate Minority Leader Mac Schneider, D-Grand Forks. “This is not us gaming a nightmare scenario. This is a nightmare scenario that is predicted to happen based on these projections.”

Given that Senator Schneider and his fellow Democrats have played pretty fast and loose with the facts in the past, and given that anyone thinking they can predict the path of the oil markets going out a full decade is fooling themselves, I think we should take these numbers with a major grain of salt.

But, for a moment, let’s stipulate to the idea that they represent an accurate forecast of what will happen in the next decade. They’re saying the state will lose $5.8 billion over the course of a decade, or about $580 million per year.

The thing is, if we do nothing and leave the oil tax trigger in place, the current revenue forecast lawmakers are using foresees a loss of more than $5.6 billion in combined general and non-general fund revenues in the next biennium due to lower oil prices, and of that is $883 million in lost revenues from the absence of the oil extraction tax specifically.

That’s what they aren’t telling you. The price of doing nothing.

Democrats would have you believe that Republicans are just out to give “big oil” a tax cut, and in order to support that talking point they’re willing to let the state weather a $5.8 billion revenue swing in the next biennium, including $873 million in lost revenues from the “triggered” extraction tax, in order to avoid reforms that would give the oil industry a much more moderate tax burden over the next decade.

That doesn’t make any sense.

The Democrats are almost certainly exaggerating the impact of lowering the state’s tax on oil extraction/production from 11.5 percent to 9.5 percent. But even if their numbers are good numbers, a nearly $6 billion reduction in tax burdens for the oil industry over the next decade is better than a totally unpredictable, multi-billion dollar swing in tax revenues every time oil prices tank.

We need to get these tax trigger land mines out of the tax code, and we can’t let Democrat hyperbole about “tax cuts for big oil” get in the way.