Ugly: North Dakota General Fund Revenues Under Forecast By Almost 4 Percent

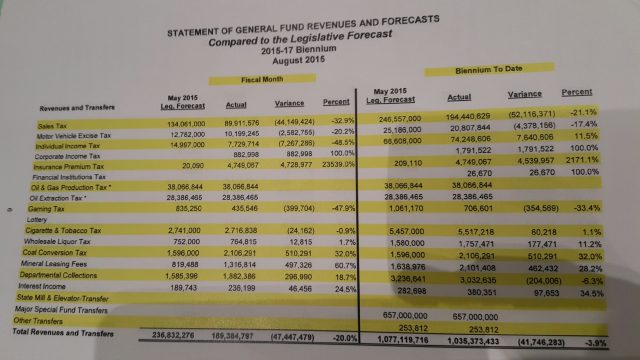

The image above is the most recent revenue report for North Dakota’s general fund. A lawmaker sent me a photo of it (OMB hasn’t posted it on their website yet) this morning with a one-word comment.

“Ugly.”

No kidding. Especially in the area of the sales tax, which makes up the bulk of general fund revenues. Biennium to date sales tax revenues are down almost 22 percent, or $52 million, from the Legislative forecast.

Biennium to date income tax revenues from corporations and private citizens are doing ok, but in the fiscal month of August personal income tax revenues were under forecast by almost 50 percent.

When lawmakers ended their session earlier this year they were projecting a $289 million ending fund balance. It seems unlikely that the state will hit that if these numbers keep up, which seems likely given the “rough road” projected for the oil industry in the coming year (emphasis mine):

“This is not a bust,” [North Dakota Petroleum Council President Ron] Ness said, noting the state still has more than 12,000 wells producing oil, and production has been stable at around 1.2 million barrels per day.

Still, with lower oil prices likely to prevail, he predicted an “interesting six to eight months” ahead, possibly longer.

To adapt to the lower prices, oil producers and service companies have been striving to become more efficient. Also, state figures show companies have drilled about 900 wells that are not producing.

“I think this fall is going to get tough,” Ness said, adding that communities in oil-producing areas — and the state budget in the next biennium — will feel the pinch.

It isn’t all bad news though. While in the month of August revenues were down 13.6 percent compared to last the same month in the last biennium, to date revenues are still up 34.5 percent biennium to date.

That’s good! But again, the Legislature budgets based on their forecast. Spending and tax decisions were made based on what they expected to come in. If actual revenues are underperforming the forecast – and so far they are – then that could mean we’re in for a budget crunch during the interim.

One mitigating factor is that the forecast did project the “big trigger” exemption to the state’s extraction tax to be in effect for 10 months. That hasn’t happened, though it’s still possible – and perhaps likely given the state of oil prices – that it will kick in for a month in December before the oil tax reforms become law on January 1 of 2016.

But one month of the oil tax exemption versus ten months is a big difference. Whether it will be enough to keep the state on pace with revenue forecasts remains to be seen, especially given that most of the oil tax revenues don’t flow into the general fund.

“There’s no way to sugarcoat the August sales tax numbers; they’re ugly plain and simple,” Rep. Roscoe Streyle, who sits on the interim Budget Section committee. “It’s really a double whammy on North Dakota’s budget with low Ag and Oil prices. A large portion of the sales tax increase over the past 5 years is directly related to drilling and the oil industry. The sales tax revenue needs to be watched very closely in the coming months. North Dakota’s economy is still strong, but it’s clear low commodity prices are impacting the state in a big way.”