There Is No Oil Bust In North Dakota

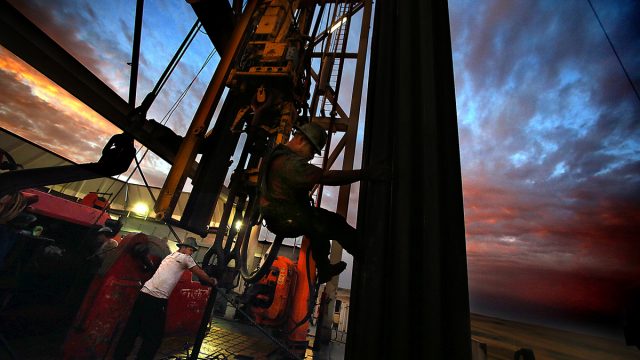

Derrick hand Scott Berreth (right) rappelled through the drilling rig structure as the crew prepared to restart machinery after some repairs had been made earlier in the morning. ] (JIM GEHRZ/STAR TRIBUNE) / December 17, 2013, Watford City, ND – BACKGROUND INFORMATION- PHOTOS FOR USE IN FINAL PART OF NORTH DAKOTA OIL BOOM PROJECT: Men work around the clock at Raven Rig No. 1 near Watford City, one of nearly 200 towering oil rigs in the Bakken. Once the rigs drill holes, several miles deep and then several miles horizontally, hydraulic fracturing technology (“fracking”) is then employed to extract oil and natural gas from the underlying shale formation.

Over the weekend I wrote about an article in the Atlantic headlined, “A North Dakota Oil Boom Goes Bust.” It was written by former Bismarck Tribune reporter Mara Van Ells and, frankly, it doesn’t reflect reality here in North Dakota.

As North Dakota-based Reuters reporter Ernest Scheyder wrote on Twitter, there is no bust and Van Ells’ reference to “Exxon Mobile” is kind of funny:

As a reporter based full time in ND's oil patch, can attest it's not going "bust" & that "Exxon Mobile" not a company http://t.co/60JxpB7XsZ

— Ernest Scheyder (@ErnestScheyder) June 30, 2015

To be clear, the company’s name is ExxonMobil. But that’s an easy and understandable mistake to make. What’s harder to understand is Van Ells’ conclusion that North Dakota is going bust.

We’re not, as I pointed out over the weekend, and today we got another data point proving that the state isn’t going bust. The taxable sales numbers have come in for the first quarter of 2015 and they’re up over the same quarter in 2014 despite an expectation that they would be down due to oil prices.

Taxable sales and purchases for January, February and March totaled $5.83 billion, nearly a 2.3 percent increase over those months in 2014, Rauschenberger said in a news release, calling the increase “a good sign.”

“With declining oil prices in the first quarter of this year, we expected to see negative economic impact including a decrease in North Dakota’s taxable sales and purchases,” he said.

In those months in 2014 the price of WTI crude ranged between the high $90’s to low $100’s per barrel.

In those same months in 2015 the price of WTI crude hovered around $50 per barrel.

Conclusion? North Dakota’s economy have proven resilient despite the downturn in oil.

Have things slowed? Yes, but both the job markets and the state’s economy remain strong by every indication available to us. There is no bust, and while things can always change, there doesn’t seem to be one on the horizon either.

The Atlantic ought to think about correcting and possibly retracting Van Ells’ story.