Smoke and mirrors? Philly cigarette tax only partially solves school budget woes

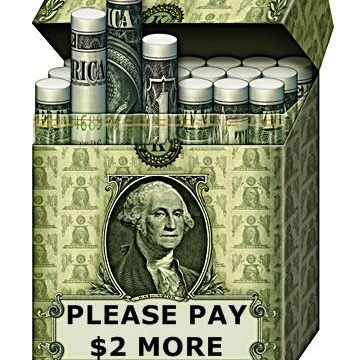

PUFF AND PAY UP: Smokers fund school deficit.

By Stacia Friedman | Watchdog.org

PHILADELPHIA — When Philly smokers light up, they’ll be doing something the Marlboro Man never had in mind: supporting city schools.

The new $2-a-pack tax — signed into law Wednesday in Harrisburg — is estimated to plug a $49 million hole in the district’s budget in the first year.

“We are thankful to all who spoke up for this important legislation, including the many students, teachers, principals and citizens,” said School District Chairman Bill Green and Superintendent William Hite in a joint statement.

However, the tax hike doesn’t completely solve the problem. On paper, the cigarette tax, combined with $32 million in cuts, closed the $81 million gap in the district’s budget. Yet the system still faces “significant deficit in the quantity and quality of the resources…in our schools,” said district spokesman Fernando Gallard.

Gallard is referencing understaffed schools, overcrowded classrooms and the lack of counselors, teacher aides, nurses and librarians. The district also had to drop electives mandated by the state, such as athletics, art and music. The next step requires more concessions from the teachers union.

“We are not seeking reductions in wages, but do need to have substantial changes to the benefit structure that is currently part of the (Philadelphia Federation of Teachers) contract,” Gallard said.

Even with all that, costs like debt service and pension obligations are only going to increase over the next few years. At the same time, a report from Philadelphia Mayor Michael Nutter’s office shows revenue from the cigarette tax is likely to decline as fewer people smoke or as a result of people buying their cigarettes outside the city’s borders.

It might not be a long-term solution, but the state General Assembly decided the cigarette tax was the best solution to the school district’s budget issues this year. After putting off a vote all summer as the district threatened to postpone the school year without additional state aid, the state House approved the cigarette tax on Monday before the state Senate followed suit on Tuesday.

Sen. Anthony Williams, D-Pa., who authored the cigarette tax bill, shares the district’s concerns.

“I fully support the legislation,” Williams said, “but it doesn’t completely meet the needs of school funding. It’s a regressive tax that will fall disproportionately on people who don’t have as much as others.”

“The state has to find a way to support public education at all levels, from early childhood on up,” Williams said. “More money is needed. Right now it will come from those who don’t have the revenue.”

In Philadelphia, 25 percent of adults smoke. However, in the poorest sections of the city, as many as forty percent of adults smoke, according to a September 2013 article in Health Economist.

Therefore, the price increase from less than $5 per pack to $7 will likely hit hardest the low-income groups who can least afford it. Smokers in the adjacent, affluent suburbs, for whom a price increase would mean less, won’t be affected.

“Regardless of whether we intended it or not, the reality is that taxing cigarettes mostly means taxing poor people,” echoes Antony Davies, associate professor of economics at Duquesne University. “We’re really simply laying a tax burden that should be shared by everyone at the feet of people who have the least political power to fight the tax.”

Philadelphia smokers seeking to avoid the tax increase might go outside the city to purchase cigarettes or take advantage of a black market that’s likely to spring up before the ink is dry on the legislation. Prices in Delaware remain at $5.47 per pack, while outside Pennsylvania counties won’t face the extra charge.

The governor, mayor and school superintendent seem to be in lock-step, but not everyone is on the bandwagon.

“While this is a significant revenue stream for Philly schools, it is also the epitome of what is wrong with Pennsylvania,” Williams said. “We are depending on smokers to close the financial hole that exists in the city.”