Ohio Legislature OKs bill to simplify local tax codes, give taxpayers some relief

By Maggie Thurber | For Ohio Watchdog

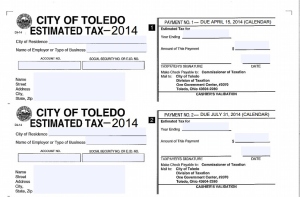

TAX REFORM: One provision of the municipal income tax reform bill would increase the threshold for filing estimated income tax from $100 to $200. Supporters say this alone would decrease the number of filings, a key goal of the bill.

Some Ohioans may see a bit more in their paychecks and businesses will have less paperwork now that a municipal income tax reform bill has passed the General Assembly.

House Bill 5 was approved by the Senate on Dec. 3 and the House concurred in the amendments Monday. The bill will no go to the governor for his signature.

The legislation has seen significant controversy during its two-year process, with businesses expressing support and municipalities opposed.

In 2013 testimony to the House Ways and Means Committee, Scott Drenkard, an economist with the nonprofit, nonpartisan Tax Foundation, said that of the 17 states with local income taxes, Ohio had the second-highest rate behind Maryland. He said Ohio’s various rules and forms unnecessarily complicate matters.

“In Ohio,” he said, “it’s entirely possible to pay local income taxes on the same dollar to more than one jurisdiction. This is an affront to the time-honored principle of avoiding double taxation.”

Ohio ranks 39th out of 50 on the State Business Tax Climate Index, worse than all neighboring states.

It was no surprise the business-backed Municipal Tax Reform Coalition supported the bill, saying it would realign the system to provide more uniformity and clarity in the process. The coalition said the current system for payment has about 300 different forms and, in many instances, constitutes an unnecessary burden on businesses.

Cities claimed the provisions would result in less income for them.

A major component of the bill is the change to the “casual entrant” rules. Under existing law, a resident could work for up to 12 days in a municipality in which they didn’t live and be exempt from paying income tax to that other municipality. H.B. 5 increases the casual entrant days to 20, though it doesn’t apply to athletes, entertainers or public figures. It also applies the rule to all compensation and not just wages or payment for service on a board of directors.

Businesses with less than $500,000 in yearly taxable gross receipts only have to withhold and pay nonresident employee income taxes to the jurisdiction where the business has a fixed location.

In a nod to the cities of Toledo and Oregon, the bill includes an exemption of the new 20-day rule for certain oil refinery workers at BP Husky and the former Sun Refinery. Their employees will still be subject to the 12-day rule for casual entrants to avert a major financial hit to the two cities.

During the Senate committee hearing on this amendment, Sen. Bob Peterson, R-Sabina, said the language was narrowly crafted to apply to the special circumstances related to the industry.

The bill increases the amount for filing estimated returns to $200. The current threshold requires taxpayers to pay quarterly estimated taxes if they will owe $100 or more in the year. It also adopts the “mailbox rule,” which says tax returns are filed if they have a postmark that is on or before the due date.

The final version includes a “Taxpayer Bill of Rights,” which prescribe procedures and limits for auditing municipal income taxpayers along with a uniform standard by which taxpayers can seek damages.

The bill helps businesses by synchronizing all municipal filing dates with state filing dates, establishing uniform withholding requirements according to a fixed schedule and standardizing the amount and time period during which a net operating loss can be deducted and carried forward.

Under current law, municipalities can choose whether or not they allowed NOLs and for how long.

The legislation also requires cities with a population of more than 30,000 to publish contact information for the person who can handle tax questions from the public.

While the goal was to simplify the system, Sen. Capri Cafaro, D-Hubbard, said during the Senate vote that businesses will still have to fill out numerous forms and the goal had “been lost in the shuffle.”

Sen. Charleta Tavares, D-Columbus, held up a copy of the current bill and the much thicker H.B. 5 while questioning if the municipal income tax system had truly been simplified.

Dan Nevin, vice president for tax and economic policy at the Ohio Chamber of Commerce, said during Wednesday’s committee hearing that raising the estimated tax payment threshold alone would “cut down on the number of tax returns,” which was a major goal of the bill.

The effective date of the bill, if signed by the governor, is Jan. 1, 2016. All Ohio municipalities must have their ordinances and resolutions updated and in compliance with the law by then.