North Dakota General Fund Tax Revenues Up 89 Percent Since 2010

Tax policy is going to be a hot debate yet again heading into the 2015 session, and while the rate of general fund tax revenue growth has slowed a bit in the 2013-2015 biennium to date (compared to 2011-2013), growth is still strong.

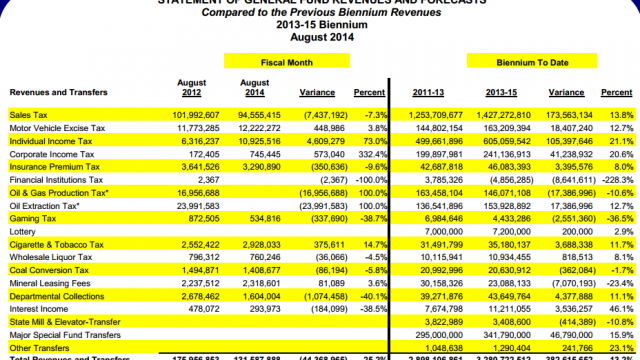

The latest general fund revenue report through August shows the state beating last biennium by 13.2 percent, or $382.62 million. Of course, at this point in the last biennium revenues were up 67.4 percent or over $1.1 billion.

Just to put that increase into perspective, the state’s entire general fund revenue take in 2007-2009 at this point was just over $1.5 billion.

So yeah, the explosive growth in revenue isn’t there any more, but how many states would love to have even a 13.2 percent jump in revenues biennium-over-biennium?

This chart shows the cumulative general fund revenues to date for the current biennium and the three previous. Keep in mind, when we’re talking about general fund revenues, we’re not talking about all of the state’s income. Not counted here are revenues diverted into funds like the Legacy Fund or the Common Schools Trust Fund. So really, this isn’t even a complete picture of the state’s massive stream of revenues.

So far in the current biennium the state is up 8.4 percent or about $254 million over projections. That means revenues were roughly a quarter billion dollars more than what was expected.

Most of that is due to far more in income tax revenues than was expected. The state has taken in more than $172 million in income tax revenues so far, a 40 percent variance. That’s not surprising given the state’s booming economy, nor is the fact that corporate income taxes (up 20.6 percent over last biennium) or sales taxes (up $172 million) are surging as well.

Oil tax revenues are surging as well. The state has already hit its $300 million cap on oil revenues deposited into the general fund. “The original forecast predicted total oil tax revenues of around $5.3 billion for the 2013-15 biennium,” reads the OMB report. “The revised forecast predicts nearly $7.5 billion.” That’s a 41 percent increase, for those of you keeping score at home.

Put simply, this state has more tax revenues than it knows what to do with. Not that there won’t be plenty of ideas for how to spend it all.

Here’s the full OMB report: