North Dakota Tops In Budget Health But Spending, Pensions Present Long Term Problems

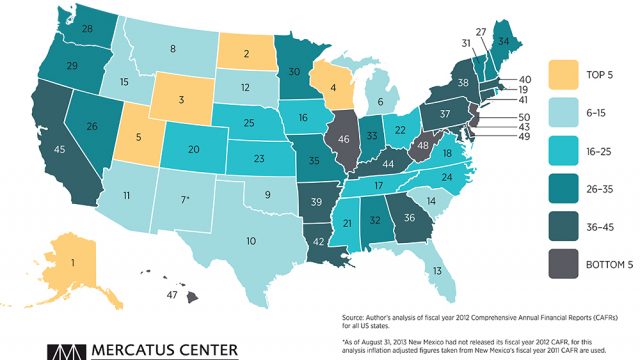

The Mercatus Center at George Mason University has released a ranking of the states based on fiscal condition. Not surprisingly, in terms of cash and budget solvency, North Dakota comes in at the top of the list at #6 and #2, respectively.

This is thanks to a roaring state economy driven by an oil boom and a strong agriculture industry.

But things get a little more interesting when Mercatus took a look at long-term solvency. While North Dakota still ranks very well – #14 out of 50 – the ranking is down significantly from the rankings of more immediate solvency.

I spoke with Dr. Sarah Arnett, the author of the study, and asked her about the disparity between the state’s short and long-term fiscal solvency. While cautioning that 14 out of 50 is still a very strong ranking, she pointed out that issues like pensions and rapid growth in state spending are pushing the state’s long-term health down.

That’s not hard to believe.

A recent state audit (which has, bizarrely, received pretty much zero media attention in the state aside from SAB, found that the unfunded liabilities in the state’s public workers pension – the Public Employees Retirement System – has zoomed past the $1 billion mark.

Auditors found that only 62.1% of the pension fund’s liabilities are funded.

North Dakota’s other big pension obligation – the Teachers Fund For Retirement or TFFR – hasn’t been audited yet in 2013, but in 2012 it was only 60.9% funded.

State spending growth has been dramatically as well. Heading into the 2013 legislative session, Governor Jack Dalrymple charted a course for a massive spending increase. Legislators took that executive budget and exploded it up to a 62% increase of 2011-2013 biennium spending.

Much of that increase in state spending was a take-over of local school spending intending to reduce property taxes. We can debate the efficacy of that spending as property tax relief (long term, it’s not relief at all), but the larger point is that booming energy and agriculture industries are pouring revenues into state coffers, making it easy to hide the burden of big spendig increases.

But these boom years aren’t the new normal. Eventually North Dakota’s revenue flows will come back down to earth, and how healthy will the state’s finances look then with massive budget obligations from these spendthrift years coupled with unreformed pension obligations are weighing on a budget with something less than astronomical revenue growth?