North Dakota Seeks To Take Advantage Of Minnesota Tax Hikes

Guest poster Mike Marcil, a North Dakota businessman, wrote here on SAB recently about the growing disparities between Minnesota and North Dakota taxes. “[A] family living in Moorhead making $60,000 per year will pay $3,626 per year in personal income tax vs. only $756 in North Dakota under the new tax rates,” he wrote. “A two income professional family living in East Grand Forks making $223,000 will now pay over $11,000 in more in annual taxes in Minnesota.”

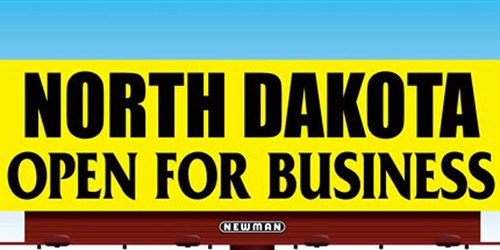

For those living in border communities between North Dakota and Minnesota, a move of a few miles could save thousands per year in taxes. The same goes for businesses, which is why North Dakota is now trying to cash in on the disparity with billboards:

FARGO — North Dakota is promoting its business climate at Minnesota’s expense.

The Greater North Dakota Chamber has created billboards that mock decisions made this session by the Minnesota Legislature, including bills that raise taxes on income and consumer products like tobacco, gas and beer.

The first billboard went up Thursday along Interstate 94 in Moorhead, which is across the Red River from Fargo. It reads “NORTH DAKOTA” on the top line and “OPEN FOR BUSINESS” on the bottom.

Other billboards are planned throughout the summer.

North Dakota could be doing more. Given the state’s revenue projections, there’s no reason to even have an income tax any more, and the state has simply been too aggressive in the area of spending.

But things could be worse. We could be Minnesota.