North Dakota Revenues Continue To Fall Behind Forecast

Even after North Dakota’s budget officials revised down revenue forecasts for the 2015-2017 biennium actual revenues continue to lag, and the gap is growing.

Last month the gap between the revenue forecast lawmakers used to budget and the actual revenues collected was 5 percent, an increase from 3.9 percent the previous month. Now the latest revenue report from the Office of Management and Budget (see below) shows a 7.5 percent gap between the forecast and actual revenues.

Budget officials are apparently talking about getting an updated forecast, per Mike Nowatzki.

Here’s a comparison between revenues and the forecast for the four months of the current biennium so far:

Even though revenues are coming in under the forecast, they’re still beating last the last biennium’s record-setting revenue totals so far, but that margin is shrinking too. Last month the state’s revenues were 15.4 percent above the 2013-2015 biennium. Through October, cumulative revenues are now less than 6 percent above the previous biennium. This chart shows the current biennium revenues compared to the last four bienniums.

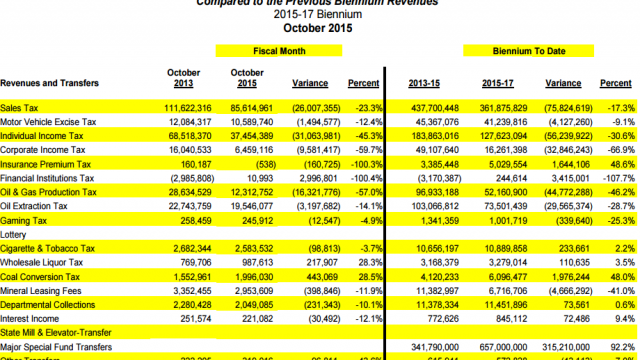

But even these figure are misleading. If you look at the OMB’s chart of revenue by source (the featured image above), you can see that the revenue streams are down across the board. So how can revenues still be up over the previous biennium? It’s because of a special fund transfer of $657 million. Yet even with that transfer, the current biennium’s revenues are only a little more than $75 million above the previous biennium.

I spoke with Pam Sharp, the director of the Office of Management and Budget, about that special fund transfer. “That was a transfer from what used to be the property tax relief fund into the general fund,” she said. “It was provided by the legislature to transfer into the general fund. At the end of the biennium the legislature eliminated the property tax relief fund.”

The $341 million transfer you see in the same category from the previous biennium was also a transfer from the property tax relief fund. The transfer in the current biennium was larger because in the last biennium the legislature also transferred some general fund dollars to the fund which was also one of the “buckets” collecting oil tax revenues.

Now those dollars are flowing back into the general fund, and distorting the state’s revenue picture a bit. Sort of like transferring money out of your savings account to balance the checkbook. Sure, things balance, but you can’t count that as revenues.

In terms of revenue, the state is seeing some pretty significant contraction.