NM is land of enchantment, reliance of federal cash

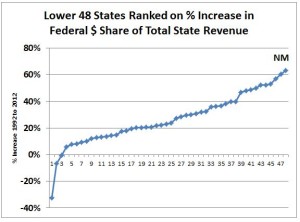

LAND OF ENCHANTMENT … AND DEPENDENCE: A calculation from a Chicago-based accounting group says New Mexico saw the nation’s largest 20-year increase in its share of revenue tied to the federal government. Source: Institute for Truth in Accounting.

By Rob Nikolewski │ New Mexico Watchdog

SANTA FE, N.M. — Policymakers in New Mexico have warned of the state’s over-reliance on federal dollars, and a fiscally conservative group hammers home that point.

New Mexico, in fact, finished first in the growth of its share of state revenue tied to the federal government, the Chicago-based group found.

Between 1992 and 2012, New Mexico’s share of federal money as part of state revenue increased a whopping 63.3 percent, the Institute for Truth in Accounting showed. The group used numbers from the most recent Comprehensive Annual Financial Report, which states submit.

“I am a little surprised by that,” said Bill Bergman, director of research for Truth in Accounting. “New Mexico is in the top quartile of states that we have concerns for about state finances, but it’s not one of the worst. I would have thought that other states like Illinois or Connecticut would have been higher on the list in terms of the growth rate.”

The calculations comprise the 48 contiguous states and exclude Alaska and Hawaii. Between 1992 and 2012, 45 of the 48 states saw an increase in their percentage of revenue related to federal money.

“Federal money is getting much more important in state finances since ’92,” Bergman told New Mexico Watchdog in a telephone interview.

Here is the list of the top five states at the top and the bottom of federal growth relative to state revenue:

The results echo a study from the Pew Charitable Trusts’ Fiscal Federalism Initiative, which came out in September and shows New Mexico as the state most reliant on government spending. The Pew study looked at things such as federal grants, procurement, retirement benefits paid out, salaries and wages from federal jobs, as well direct payments from federal programs such as Medicare, Medicaid and disability payments. It concluded more than 35 percent of New Mexico’s gross domestic product comes from Washington.

Bergman said Truth in Accounting takes a detailed look at the Comprehensive Annual Financial Reports and includes each state’s pension and health-care liabilities as part of the debt obligations.

Bergman said Truth in Accounting takes a detailed look at the Comprehensive Annual Financial Reports and includes each state’s pension and health-care liabilities as part of the debt obligations.

Bergman said he wasn’t exactly sure why New Mexico finished first in the rate of growth. New Mexico has one of the highest rates in the country of people on Medicaid — 28 percent in 2010 — but Berger said Medicaid percentages have gone up in all states in the past 20 years.

So why is reliance on federal dollars a concern?

Because, Bergman said, the federal government’s fiscal problems have a greater impact in a state such as New Mexico.

“From our framework, the federal government is in worse shape than any of the 50 states, looking at the off-balance sheet obligations that the federal government has incurred and not really reported,” Bergman said. “And our national debt ceiling figures are really kind of a charade as what the actual debt is out there. If our federal government is less willing or able to grow its debt in the future as it has in the past, federal money for states may not be as freely available. So, if you’re dependent on federal money, you may be at risk.”

There is one potential bit of good news, however. Last year the Legislature passed and Gov. Susana Martinez signed into law a public pension fix. If it works as designed it will reduce part of New Mexico debt exposure. Since the legislation was passed in 2013, it was not part of the CAFRs used in the Truth in Accounting figures.

Contact Rob Nikolewski at rnikolewski@watchdog.org and follow him on Twitter @robnikolewski

The post NM is land of enchantment, reliance of federal cash appeared first on Watchdog.org.