Oil Price Pain: North Dakota's Budget Shortfall Is $1.074 Billion

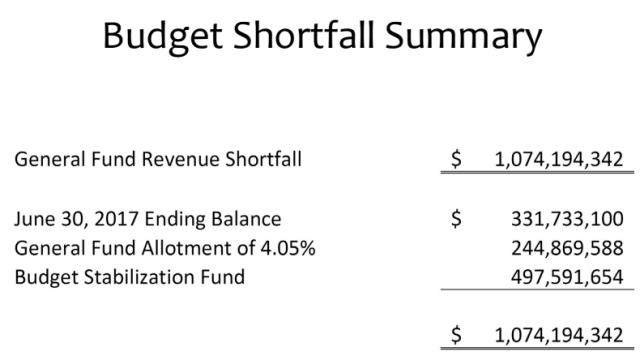

The state budget just took a $1.074 billion hit today.

An updated revenue forecast is being released today. Below is a PDF document being distributed to lawmakers – and shared with me by one of them – showing some of the specifics about which revenue streams are getting hit, and how the state will make up the shortfall.

As you can see from the screenshot above, the state will use all of the projected $331 ending balance from the 2015-2017 biennium to make up the shortfall, as well as $497 million from the Budget Stabilization Fund and $244 million in budget cuts.

That would pretty much drain the stabilization fund. According to the last report from the Retirement and Investment Office which oversees the fund, the balance was $574 million as of November 30.

And by the way, Dalrymple went big on the allotments. In order to access the stabilization fund the state has to do across-the-bard 2.5 percent cuts. But some have called for bigger cuts in order to avoid draining the state’s various reserve fund (those behind the stabilization fund because that one is definitely getting drained). House Majority Leader Al Carlson has called for 5 percent cuts.

Dalrymple didn’t go that far, but he didn’t stick to the 2.5 percent cuts either.

Here’s the revised forecast for the various general fund revenue streams.

As you can see, the big hit is in sales tax revenues, with the state expected to collect $743 million less. The corporate income tax is another big hit at over $202 million.

There is expected to be no impact to the general fund from direct oil taxes, however. Revenues from those taxes are capped at $300 million per biennium and the expectation is that the state will still hit that figure.

Most of the oil tax revenues flow to other funds and entities, however, and those are taking a bath.

So a $967 million revenue downgrade for the various oil tax buckets (the Legacy Fund, etc., etc. above), and a $1.074 billion downgrade in other tax revenue streams (sales tax, income taxes, etc.) which were heavily influenced by oil activity.

That’s a massive hit.

Here’s the full handout lawmakers were distributed today: