Nearly Three Years After Standing Rock Protests North Dakota Signs Agreement With Tribal Government to Facilitate Oil Production

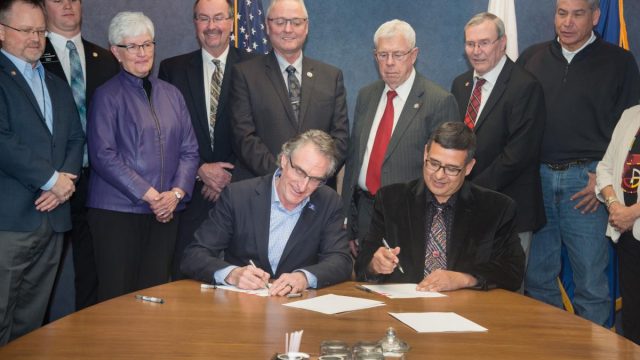

Three cheers for Governor Doug Burgum and Mandan, Hidatsa and Arikara Nation Chairman Mark Fox who, yesterday, signed a new agreement to share tax revenues from oil activity on tribal lands.

It’s a big deal, and noteworthy coming as it does nearly three years after the beginning of the #NoDAPL protests against the Dakota Access Pipeline.

Back in 2016 political extremists shouting slogans like “keep it in the ground” descended on south central North Dakota where they trespassed, set construction equipment on fire, threatened construction workers, and instigated conflict with law enforcement. There’s was not a protest against a pipeline. It was a protest against oil development, generally.

Yet the MHA Nation, which makes its home on the Fort Berthold Reservation to the northwest of Standing Rock, has benefited greatly from oil development. Hundreds of millions of dollars in tax revenues have flowed to this tribe, which has just over 16,000 enrolled members, and the new tax agreement will enhance those revenues further.

“The agreement would send 80 percent of oil tax revenue from trust lands to the tribe, while 20 percent would go to the state. For fee lands, which are private lands within the reservation, the state would receive 80 percent of the oil tax revenue and the tribe would receive 20 percent,” Amy Dalrymple reports for the Bismarck Tribune. The state Senate has already passed a bill approving this agreement. It will get a committee hearing in the state House soon.

Currently the tax split is 50/50. The new arrangement is expected to net the tribe over $33 million in additional revenue in their 2019 – 2021 budget cycle, depending on the oil markets of course.

But the state benefits as well, which Burgum pointed out at yesterday’s signing ceremony:

…Burgum emphasized that creating a stable tax and regulatory environment will help the tribe and the state by attracting additional investment. The addition of one drilling rig is estimated to add $16 million in increased tax revenue per biennium, according to estimates from the state tax commissioner.

A stable, predictable tax code is a big deal for the oil industry which, by its nature, can be extremely volatile. The state and the tribe have been at odds over this issue for years. An agreement brings certainty to the industry, making investment in development on tribal lands more attractive for oil developers.

Which brings us back to the Standing Rock protests. They were violent and ugly and in many ways drove a wedge between the state’s tribal and non-tribal communities. They were also, at their heart, fundamentally anti-oil.

And yet here we are, roughly three years removed, and the state and the tribe have struck what both sides are describing as a historic agreement to help facilitate oil production on tribal lands.

That’s good news for our state’s economy, and good news for a future of comity with our tribal neighbors.