Is sales tax holiday good or bad for Ohio?

By Maggie Thurber | For Ohio Watchdog

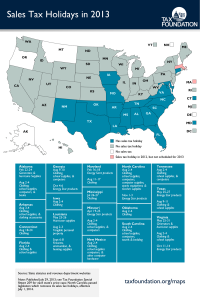

HOLIDAY: In 2013, 17 states offered a sales tax holiday for various items, including school clothing and supplies. Will Ohio join the group in 2014?

Ohio is once again considering an August sales tax holiday for schools supplies and equipment, but two tax groups think it’s a bad deal for taxpayers.

House Bill 450 would provide a three-day “holiday” each August. Sales and use taxes would not be charged on back-to-school clothing, school supplies, personal computers and personal computer supplies.

Bill sponsor Rep. John Patterson Jr., D-Jefferson, thinks passage of the measure would generate activity in retail stores and help create excitement that could rival the post-Thanksgiving Black Friday sales.

Matt Gardner, executive director of the Institute on Taxation and Economic Policy, says such thinking is noble but is poor tax policy.

“Anything that reduces the sales tax ought to be a step up in terms of making the taxation fair,” he said. “But holidays are an ineffective way of achieving that goal.”

Gardner said one of his biggest concerns with state tax policy is that it’s regressive and falls most heavily on low-income taxpayers.

“This is true for Ohio,” he said. “Low-income consumers spend more of their income on sales tax than upper-income consumers.”

It’s not just the left-leaning ITEP that opposes sales tax holidays. The right-leaning Tax Foundation also thinks it’s a poor substitute for real tax reform, despite the popularity.

“Sales tax holidays introduce unjustifiable government distortions into the economy without providing any significant boost to the economy,” the Tax Foundation says in one of its publications. “They represent a real cost for businesses without providing substantial benefits. They are also an inefficient means of helping low-income consumers and an ineffective means of providing savings to consumers.”

Gardner said it was “remarkable” to see the agreement on the issue of sales tax holidays.

“It’s hard to find a tax expert who thinks this is a good idea. It’s pretty rare to see such wide-spread agreement on any issue.”

If tax experts and think tanks from opposite sides of the political spectrum all agree that sales tax holidays are a bad idea, then why do so many legislators support them?

“Holidays may make lawmakers feel as if they’ve done something positive, but it’s only a temporary reprieve,” Gardner explained. “It’s also possible that lawmakers know full well they’re not making meaningful changes in the tax system, but they love the PR. It’s an idea that can be sold to voters but doesn’t break the bank.”

During sponsor testimony on the bill, Patterson told the House Ways and Means Committee that many families in his district travel to Pennsylvania to buy school clothes because that state doesn’t charge sales tax on clothing.

“The border counties are getting hit hard with this,” he said, adding that his bill would encourage those families to buy clothing in Ohio, which would create a multiplier effect on spending that would continue to be taxed.

“Looking at Pennsylvania isn’t a good long-term example,” said Gardner. The state is debating elimination of the clothing exemption. “Besides, consumers don’t really travel for a 5 percent tax break.”

He said most consumers won’t have the financial flexibility to alter their purchases to coincide with the holiday, and those who do probably aren’t going to be the largest chunk of consumers.

Gardner asked why a local issue of consumer travel across a state line required a statewide solution.

ITEP and the Tax Foundation both say there are better, permanent alternatives to a gimmicky sales tax holiday.

“If a state must offer a ‘holiday’ from its tax system, it is a sign that the state’s tax system is uncompetitive,” the Tax Foundation says on its website. “If policymakers want to save money for consumers, then they should cut the sales tax rate year-round.”

“Sadly it’s a poor alternative to enacting good policy, but the cost of enacting bad policy is very low and the benefits for lawmakers is very real,” Gardner said. “The better solution would be to fix the disproportionate impact Ohio’s tax policy has on low-income families. There are better strategies out there.”

You can reach Maggie Thurber via email at maggie@ohiowatchdog.org