Illinois residents paying more taxes for fewer services

By Benjamin Yount | Illinois Watchdog

SPRINGFIELD, Ill. — If you only look at the government spending you can see, such as roads and school buildings, Illinois taxpayers would appear to get an okay return on their investment.

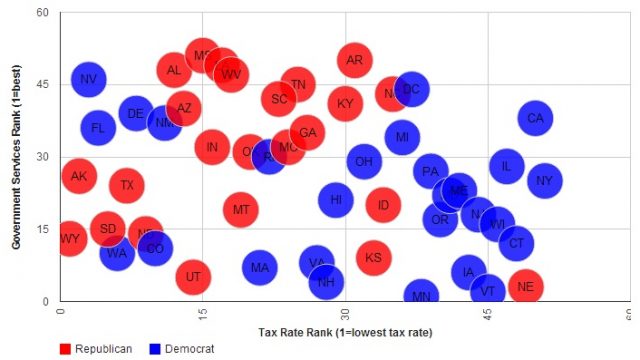

BIG GOVERNMENT: Illinois’ high taxes and big government put it in the middle of Wallethub’s survey

But it’s the spending you don’t see that has taxpayers paying more and more for less and less.

A new survey by WalletHub.com ranks Illinois 39th in the nation in return on investment for government spending.

“Illinois is 47 when it comes to tax rates. It has some of the highest state and local tax rates in the country,” WalletHub.com’s CEO Odysseas Papadimitriou told Illinois Watchdog. “But when you look at the government services, Illinois ranks 28.”

WalletHub ranks states based on the quality of roads and bridges, the rank of each state’s schools, the number of hospitals and the cost of medical care, the violent crime rate, the unemployment rate and the state’s pollution level.

Illinois is not in the top five in any category, but is only in the bottom five for having poor water quality.

“Those (categories) we feel are the primary responsibilities for each state,” Papadimitriou said. “To provide good infrastructure, good education, good health system, safety for its residents, a low level of pollution and a robust economy.”

But by looking only at those measures, Wallethub ignores some significant problems for Illinois.

The state has the third worst unemployment rate in the nation, but Wallethub offset Illinois’ 8.4 percent unemployment rate by considering the average cost of living, the number of people who have left the state and economic mobility.

Wallethub also ignores Illinois’ massive debt — both the state’s $130 billion pension debt and the $6 billion in unpaid bills currently sitting at the state Capitol.

“The pension obligation debt is eight times all the bond debt for building roads and schools and everything else,” said Bob Williams, president of State Budget Solutions. “Essentially, the state has been living on credit cards.”

Wallethub doesn’t factor in any of the costs of debt, either at the state or local level.

Williams said that debt must be counted to know the true cost of government, as most taxpayers are paying for a lot more government than they ever see.

He said those who work for or depend on the government get a fantastic return on investment. The rest of Illinois’ taxpayers don’t.

“Not only do you (not get a return) you are expected to pay for the cost of that public employee,” Williams said.

Wallethub, unsurprisingly, ranks the energy boom states in the northern plains as the best for return on investment and a handful of states in the south as the worst.

Reach Benjamin Yount at Ben@Ill;inoisWatchdog.org and find him on Twitter @BenYount.