Hawaii will go bust by 2016, Senate minority leader says

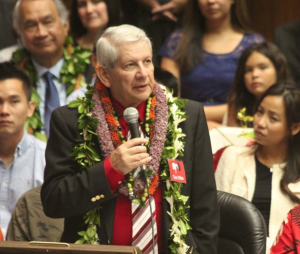

GO BUST: Hawaii Senate Minority Leader Sam Slom says the state will be in trouble financially by 2016 unless the government cuts spending

By Malia Zimmerman | Watchdog.org

HONOLULU — Hawaii Senate Minority Leader Sam Slom is warning fellow lawmakers he has serious concerns about the state’s economic future.

Slom, the only Republican in the 25-member Senate, cites the Council on Revenues’ recent downgraded economic forecast indicating Hawaii is in a much worse financial position than anticipated.

“Hawaii is set to go bust in 2016 unless the new governor and the state Legislature make some serious cuts,” Slom said.

The administration and Legislature will be challenged, Slom said, “in dealing with the mess resulting from kicking the can down the road for so many years.”

“The final option to deal with the problem by raising taxes is the least desirable and burdensome for the people because we are already one of the highest taxing states in the nation,” Slom said.

The state Council on Revenues, the appointed body that predicts economic trends in Hawaii from which lawmakers create their budget, lowered its projections for state general fund revenue on Sept. 4 for fiscal year 2014 from -0.4 percent to -1.8 percent, or a loss of $76 million in anticipated general fund revenue.

The Council also lowered its projections for fiscal year 2015 from 5.5 percent to 3.5 percent, or an additional $188 million in anticipated loss of general fund revenue.

This is the fifth consecutive time the council has lowered its projections, said Paul Harleman, the budget director for the Senate Minority Office.

Harleman said the state must absorb a loss of $264 million of anticipated general fund revenue during the state’s two-year budget cycle.

Gov. Neil Abercrombie’s administration has made some cuts, asking state department to restrict funds by 10 percent.

However, Slom said that will not be enough to of a halt “to stop the freefall” because the $14 million Abercrombie’s move adds up to is just a “drop in the bucket” in the state’s a $6 billion state budget.

“Because the state is not constitutionally permitted to borrow from outside sources for operating expenditures, it is likely the state will tap into the Emergency Budget Reserve Fund and Hurricane Relief Fund,” Slom said. “Those funds are not large, so that will be a small Band Aid for the problem and will not address the problem of overspending for long.”

Kalbert Young, director of the Hawaii’s Office of Budget and Finance, said he agrees the state is “headed into a situation where there is anticipated fiscal year imbalance” because spending is outpacing revenue.

The combination of the state ending balance and formal reserve balances in the Hurricane Relief Fund and the Emergency Budget Reserve Fund dropping below what he set as acceptable target levels, also concerns Young.

“I have been of the opinion that the state should target combination of reserve and ending balance to be no less than 10%, but also to be of an objective to build formal reserves to be equal to 10% of the general fund budget over time. Currently, formal reserve levels are projected to be 4.4% of FY15 general fund budget. The combination of strong ending balances helped to keep Hawaii’s reserve and ending balances at or above the 10% target. Now, with declining ending balances a possibility in the future and reserve levels at 4%, there is a risk that Hawaii would have inadequate reserve levels during the next economic down-cycle,” Young said.

Young said that unlike Slom, he remains “bullish on the state economy continuing to improve over the next two to three years, translating to increased tax revenue.”

“The challenge is to ensure that expenditure growth over that same period does not outpace revenue growth,” Young said.