Ed Schafer: In Defense of the Legacy Fund

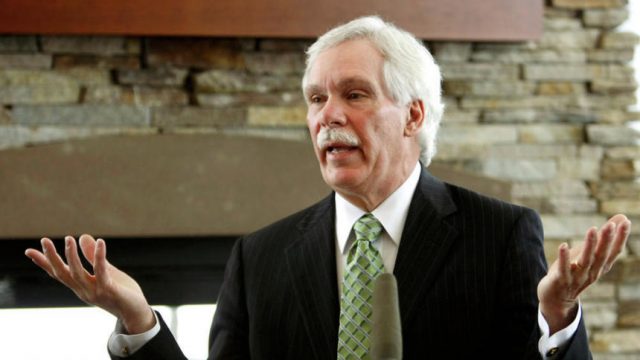

Former North Dakota Governor Ed Schafer announces the "Fix the Tax" campaign to lower during a Monday morning press conference in Fargo to lobby for lower oil production taxes. Michael Vosburg / Forum Photo Editor

This guest post was submitted by former North Dakota Governor Ed Schafer.

Last December Rob Port posted an article on the Say Anything Blog titled, “It’s Time to Stop Listening to the Legacy Fund Hoarders!”

I was surprised to see him write against fiscal conservatism. Since many people seem to have taken Rob’s comments to heart and have put forth umpteen proposals to spend the money in the Fund, I believe some historical context is in order.

In 1995, the Legislature passed a tax holiday for the new technology of the time—horizontal drilling. The tax incentive created increased investment and revenue for the state, but it was coming from a depleting resource. The oil being pumped, and that still to be discovered, would eventually run its course, and it would be fool-hardy to spend the tax revenue as if it will last forever.

So, in 1997, we initiated from the Governor’s office the idea of a permanent oil trust fund to hold tax revenue in a savings account and use the earnings for general fund expenditures, if needed.

[mks_pullquote align=”right” width=”300″ size=”24″ bg_color=”#ffffff” txt_color=”#000000″]The thought was to put money in a trust fund that would grow as the oil formations depleted. And if we did not remove the money from the account, it that would eventually grow to the level that generated the same amount of revenue to the general fund that the oil taxes would be contributing.[/mks_pullquote]

The thought was to put money in a trust fund that would grow as the oil formations depleted. And if we did not remove the money from the account, it that would eventually grow to the level that generated the same amount of revenue to the general fund that the oil taxes would be contributing. Then when we pumped out all the oil decades later, the general fund budget would be stable because of the earnings from the trust fund. This is becoming more important discussion today because energy taxes are way over balanced in our revenue stream (close to 30%), and we are creating a spending dependency on our depleting revenue source. We will be generating revenue many years from now, and with this fund we can avoid increasing taxes to pay for our spending needs.

We introduced legislation to that effect, and the Legislature passed the new policy. Unfortunately, the Legislative leaders would not go along with the constitutional protection we asked for. Our fears were realized when legislators raided the fund for never-ending spending requests. Ten years later, when we should have accumulated about a billion dollars in the fund, we had only saved a couple of hundred million.

Citizens understood this concept better than legislators and helped craft a constitutional measure setting up the Legacy Fund to sock away money to eventually replace the depleting resources of our oil industry. Voters overwhelmingly supported the initiated measure by 64%, and the first deposits went into the fund in 2011. The principle amount has now grown to 5.5 Billion dollars.

I am absolutely convinced that if our citizens would not have constitutionally protected the Legacy Fund, Governors and the Legislature would have raided this savings account many times over.

In the last budget cycle, the Legislature used anticipated earnings ($200 Million), from the fund to balance the budget—a fundamental purpose of the Legacy Fund.

Our State Treasurer estimates the fund will grow to $12.6 Billion by 2025; $13.5 Billion if we save the earnings. And by 2035 we’d top 20 Billion; $25 Billion if we saved all the earnings. Won’t it be grand when we have $20 Billion in the fund? If it would earn only 5%, the Legacy Fund would contribute 1 Billion dollars to the general fund to be spent for the education, health and safety of our citizens. That’s legendary!

So, you see Rob, it’s not hoarding. Let’s fill the hole that is being made by emptying our oil reserves with dollars so we can provide stable funding for responsible spending by our government. It is the right thing to do!