David Flynn: Pete Rose, Public Policy, And Incentive Alignments

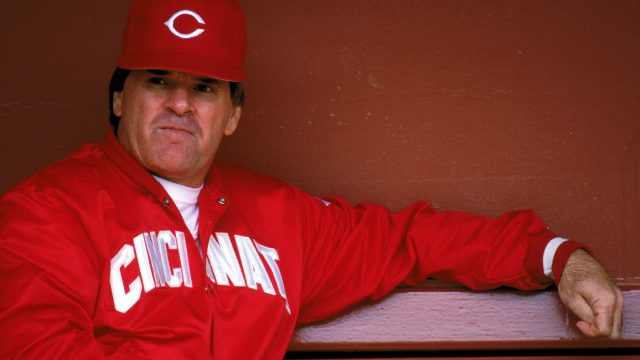

Manager Pete Rose

There are few things I care about less than the Major League Baseball Hall of Fame now. On a personal level I am bitter about the way the voters treated Ron Santo. Also, I am just flabbergasted at the treatment of the steroid-era players. The voters are embarrassed, pure and simple.

It is a really personal issue for them and as a result I lack much of the respect I had for them in my youth. The amazing thing is if they remembered how to be journalists at any point in the 1980s or 1990s maybe they would have discovered information about the situation in a timely manner. But they didn’t. Instead they were too busy thumbing their nose at the football writers telling them that baseball did not have a P.E.D. problem like their sport.

They also have a ridiculously convoluted voting system that creates a separate standard as well. It is not good enough to just be in the Hall, it is now important to be a first-ballot selection. This creates a completely different set of standards that matters mostly to the voters and few others.

So let’s be clear about this, at a very real level I do not care if Pete Rose gets into the Hall of Fame or not.

[mks_pullquote align=”right” width=”300″ size=”24″ bg_color=”#000000″ txt_color=”#ffffff”]We need public policy officials to have the incentive to act in our best interest, preferably over the long run.[/mks_pullquote]

There is an opportunity to discuss this in terms of incentives though. This week it came out that Rose may have placed bets on the Reds as a player. Except in certain situations, to this I say so what. If he bet on the Reds to win, and there was not a point spread aspect to the wager then there is no incentive alignment issue here. What I am saying is that Rose would want to win and would do what it would take to win. Now if there is a point spread involved you can get a run-shaving scandal going and there is a problem.

There is no situation where betting on his team to lose in anything other than a conflict of interest and a situation of incentive incompatibility. Not that Pete Rose has any character or credibility left to stand on, but if he bet on his team to win it is really a bit of a yawner.

Now there is really no way that it is acceptable for the manager of the team to wager on the team. The manager has the ability to impact many aspects of the game: for example making substitutions that may be in his personal interest to win the wager but not the long-run team interest, or he could make sure they do not win by too much in the case of point spreads. There is simply no way to avoid the issue of incentive incompatibility here. This is the bigger deal and the one that we have known about it for years. Now as I said before, I really do not care if Rose gets into the Hall of Fame, so let’s talk incentives in a more meaningful context.

Incentive compatibility has long been discussed and known as an issue in the arena of executive compensation. The issue here is how you compensate managers in such a way that align their interests with those of company shareholders. So it is an issue known in the private sector, but I think it too often goes unnoticed in the public sector. Whether we want to think about regulation, tax policy, spending policy, politicians often have an incentive to act in a way that is not in the best interest of the constituents.

As an example, think about a state with an economy that is growing, but not terribly well. If I lowered taxes and increased spending that might increase the GDP of the state, but there are deficits created as a result and if I don’t reverse this at some point the deficits will increase government debt and create other potential problems.

We need public policy officials to have the incentive to act in our best interest, preferably over the long run. Not that the short run is unimportant because it surely is. There needs to be a recognition of the tradeoffs between short-run and long-run considerations.

If an economy needs countercyclical policy that creates deficits in the short-run, that might be acceptable if there are long-run plans that will correct any short-term imbalances. That is really what is in our long-run best interest, but politicians and policy authorities seem to have forgotten that. Instead there seems to be a belief in constant priming of the growth pump, as if there will never be negatives. It is almost an addiction, much like gambling.