Billion-dollar windfall or job-killer? Candidates for governor still at odds over gas tax

By Rachel Martin | Watchdog.org

PITTSBURGH — The gubernatorial election finally could help settle a longstanding question about natural gas drilling and taxes in Pennsylvania.

The debate over whether the state should levy a severance tax has dogged Gov. Tom Corbett throughout his term. During his 2010 campaign, he had pledged not to raise taxes, but managed a workaround through a per-well impact fee system that went into effect in 2012.

Now, Democratic challenger Tom Wolf prominently features a severance tax in his “Fresh Start” campaign, pledging to spend the potential billion dollars a year on perceived education budget shortfalls, among other things.

Proponents of the tax see the drilling boom as an obvious revenue source that Pennsylvania has largely left untapped, but imposing higher taxes on the industry likely means less investment and less production.

Wolf has a sizable lead in pre-election polls. If he topples Corbett in November, he says he will push for a 5-percent severance tax

Jeff Sheridan, spokesman for Tom Wolf’s campaign, says the 5-percent tax would generate $1 billion in 2015.

That’s different from the impact-fee system, which assesses a fee per well for up to 15 years, as long as the well produces a minimum amount. Corbett signed the impact-fee law in 2012. Last year, it generated $225 million.

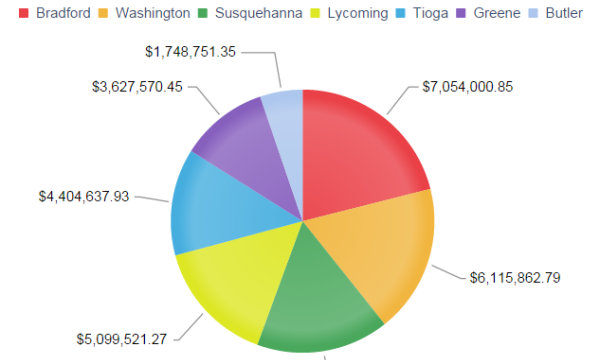

SHALE IMPACT FEES BY COUNTY: This chart shows the top recipients of the impact fees. Bradford County led the pack last year with $7 million.

Much of that revenue is sent back to the municipalities and counties where wells are located. Wolf’s severance tax plan would see revenue flow to both state and local government coffers.

“By law, a severance tax would replace the impact fee,” Sheridan said, but this plan “will direct a portion of the revenue generated from a 5-percent severance tax back to the communities affected by drilling.”

What portion that might be apparently has not yet been determined.

Sheridan said the remaining funds would go to “Wolf’s top priorities like education, infrastructure and environmental oversight.”

Pennsylvania is the only state with significant natural gas production that does not impose a traditional severance tax based on the volume or market value of gas production, according to the Independent Fiscal Office.

The Pennsylvania Budget and Policy Center, a Harrisburg-based think tank, say Pennsylvania’s “letting the goose escape with the golden egg, leaving us with an empty nest to clean up.”

Corbett and others maintain a severance tax would kill the golden goose.

Antony Davies, an associate professor of economics at Duquesne University, said dangers lurk should a severance tax be imposed.

“Any time the government taxes something, the market produces less of it,” Davies said. “It doesn’t matter what it is: cigarettes, alcohol, clothing, labor income or resource removal. So the severance tax will, definitely, reduce the amount of fracking.

“The state’s hope is that the reduction in fracking won’t be too much, so that we lose few jobs and so that there is still a decent amount of fracking going on to be taxed,” Davies said.

Chris Pack, communications director for Corbett’s campaign, confirmed that possible job losses are “absolutely” a major reason Corbett opposes a severance tax on the oil and gas industry.

Pack also questioned why only the oil and gas industry should be subject to a severance tax. Noting that Wolf’s business is in kitchen cabinets, Pack posed the question, “If the kitchen-cabinet industry ever takes off in Pennsylvania, will Secretary Wolf support a tax on that industry?”

Wolf served as secretary of revenue under former Gov. Ed Rendell.

If Wolf wins, his severance-tax plan likely will face a Republican-controlled General Assembly.

But there has been bipartisan support for higher taxes on the natural gas industry in the past, and members of each political party have introduced bills to implement a severance tax.

Some have an effective rate even higher than Wolf’s proposal, implementing a 5-percent tax on top of the impact-fee system.

Whether coming from Democrats or Republicans, those plans have been a non-starter with Corbett since he took office.

Senate Majority Leader Dominic Pileggi, R-Chester, said this month that Corbett’s opposition the tax was a mistake and his low polling is due in part to his opposition to the tax.

“Love him or hate him, the governor kept his word,” Pileggi said.

Asked if Corbett would sign a severance-tax bill if one came across his desk, spokesman for Corbett Jay Pagni said he was “not going to speculate,” because there’s no bill poised to be before Corbett in the remaining days of the legislative session.

Marcellus Shale Coalition spokesman Travis Windle said the industry already is “responsible for nearly $2.8 billion in tax and fee revenues” and works with 1,347 different businesses across the state.

Windle said that shale development is boosting locally based small- and medium-sized supply chain businesses that are also paying taxes, investing locally and creating jobs, while at the same time reinvigorating manufacturing, lowering utility rates and bringing CO2 emissions down to a 20-year low.

“Not every shale producer is going to pick up and move if a new job-crushing energy tax is enacted. We’re not saying that,” said Windle, adding the burden will be felt by those corollary companies.

Plus, he said, additional taxes make Pennsylvania less attractive to capital.

Windle said that the current impact fee has already had that effect.

“Capital flows like water — it will find the path of least resistance.”