Floridians work 4 1/2 months to pay total tax bill

By William Patrick | Florida Watchdog

TALLAHASSEE, Fla. — Tuesday, April 15, isn’t just the deadline to file income taxes with the Internal Revenue Service. For Floridians, it’s Tax Freedom Day.

It takes 4 1/2 months for Floridians to earn enough money, on average, to pay off their total federal, state and local tax bill, according to the Tax Foundation, a Washington, D.C.-based nonprofit.

Put another way, millions of Floridians will work until April 15 this year before they earn their own first dollar.

Lyman Stone, an economist for the Tax Foundation’s Center for State and Tax Policy and author of the study, said Tax Freedom Day is about providing perspective for taxpayers.

“There’s an important discussion to be had about the proper role of government. Some want it bigger, and some want it smaller,” Lyman told Watchodg.org in a phone interview.

“But it’s essential to that discussion to understand what government actually costs.”

In 2014, Americans will pay about $4.5 trillion in taxes. That’s more than the total combined cost of clothing, housing and food, according to Stone.

Even without a personal income tax — a selling point for attracting retirees and out-of-state businesses — Florida ranked 25th among states.

Call it a catch-22. Federal income taxes slam high-income earners looking to save in the Sunshine State and targets investment income, such as stocks, bonds and pensions that many retirees depend on.

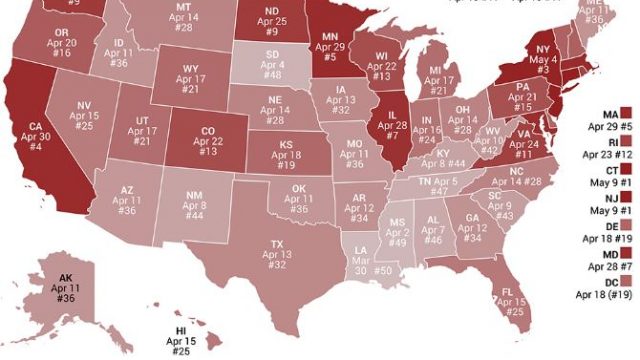

States in the Northeast, upper Midwest and on the Pacific Coast fared the worst; Southern and Western states tended to have lower tax burdens.

FREEDOM: It takes Floridians four and a half months to earn enough to pay their total tax bill.