Great Expectations: States still use unrealistic pension assumptions

By Eric Boehm | Watchdog.org

MINNEAPOLIS — Two years ago, when Rhode Island passed bi-partisan legislation to reform a state pension system that threatened to bankrupt the budget, it was hailed as an example for other states to follow.

Now, Rhode Island is once again an example for other states struggling with their own pension issues. But it’s not so sunny this time around.

A recent audit of the state’s pension system by Cheiron, an actuarial firm based in McLean, Va., concluded the state was unlikely to achieve its expected 7.5 percent annual rate of return in its pension system. The audit said the state should consider lowering those expectations because there is only a 40 percent chance of hitting those goals.

Coming up short of the expected rate of return — technically known as a “discount rate” in the world of finance — means higher contributions will be necessary from the state’s taxpayers.

The report has national implications.

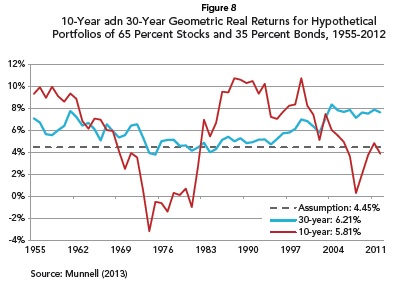

EXPECTING SOMETHING ELSE? Over the last 30 years, state pension plans have had their ups and downs. But they haven’t consistently delivered on expected rates of return that top 7 percent in most states.

“If Rhode Island is going to have a hard time earning returns of 7.5 percent, there isn’t any reason to think other states are substantially better or worse at investing their pension dollars,” said Rick Dreyfuss, a retired actuary and pension expert for the Manhattan Institute, a fiscally conservative think tank.

A recent study by the Society of Actuaries, a national industry group, concluded that states and municipalities shouldn’t use discount rates that are unlikely to be achieved.

“Plans should be using rates of return that they believe can be achieved over the next 20- to 30-year period with a 50 percent probability,” the group concluded.

Rhode Island knows it’s unlikely to hit the targeted rate of 7.5 percent, but that expected return is actually slightly lower than the national average of 7.77 percent, according to the most recent survey from the National Association of State Retirement Administrators, another industry group.

Some states have begun to adjust their expectations downward in recent years, but even so, most states still expect much greater returns than they are likely to get in the long run. That’s a problem.

In theory, a fiscally-sound pension system rests on a “three-legged stool” made up of investment returns, contributions from employees and contributions from employers (in the case of a public pension system, those contributions come from taxpayers via the federal, state or local government).

Though the exact math varies from state to state and system to system, the basic model is the same, whether you’re looking at Rhode Island or California or anywhere in between.

If the investment returns come up short of expectations, that shortfall has to be made up with higher contributions from the other two “legs” on the stool.

Employee contributions are usually fixed as part of a collectively bargained contract. That means the employer is usually the one who has to make up the difference.

In the private sector, these kinds of pension plans are nearly extinct; long since replaced by 401(k)-style plans that let individual workers assume the risks and rewards for investing in their retirements.

The few private sector pension plans that are left must operate under much stricter rules. Federal law requires a discount rate in line with high-level corporate bonds — seen as one of the safer, more conservative investment options — that rarely climb above 5 percent.

Though no one can predict investment returns, an 8 percent rate seems “unrealistic,” and pension funds should use more conservative expectations, said Robert Pozen, a professor at Harvard Business School and senior fellow for the Brookings Institution, a nonpartisan think tank.

“These things should be done conservatively so the retirees know what they will have,” Pozen said. “You don’t want to create an incentive for politicians to underfund the plans.”

There are major political reasons why states don’t lower their discount rates.

For one, it adds potentially billions of dollars to states’ already deeply indebted pension funds.

Rhode Island reduced its discount rate from 8.25 percent to the current level of 7.5 percent in 2011, but the small adjustment added $125 million to the state’s funded pension liability.

But that’s a small state with a relatively small pension system. In a big state like Illinois — already dealing with a $146 billion unfunded liability by its official accounting — using a more reasonable expected rate of return means the state is on the hook for more than $272 billion in unfunded pension debt.

Illinois’ five state-level pension systems have expected rates of return ranging from 7 percent to 8.5 percent, but none of them have earned better than 6 percent over the last decade.

Using a different, lower, rate — the rate required for corporate pension plans — would cause the overall liability to hit $1.8 trillion, Pew estimated.

“If investment returns are disappointing and do not meet expectations, states are still required to pay retirees the benefits they have earned,” the authors of the Pew report wrote.

Politicians who have limited budgetary dollars to spend have an incentive to keep rosy projections on the books to keep the current pension crisis from appearing worse than it really is. A higher expected rate of return means lower mandatory contributions from the state budget.

“The reason why people use these higher rates of return is to avoid having to put in higher contributions year after year,” said Pozen.

But if the expected higher rates of return don’t materialize, the bill still has to be paid.

Boehm is a reporter for Watchdog.org and can be reached at EBoehm@Watchdog.org. Follow @EricBoehm87 on Twitter for more.

The post Great Expectations: States still use unrealistic pension assumptions appeared first on Watchdog.org.