Do Fargo Voters Expect The State To Keep Picking Up School Tab?

I was surprised to learn last night that Fargo voters had shot down an opportunity to keep their taxes high. Traditionally voters in that city seem to like taxing themselves, but this time around a majority showed up to tell the school district to lower their mill levy to the state-mandated cap.

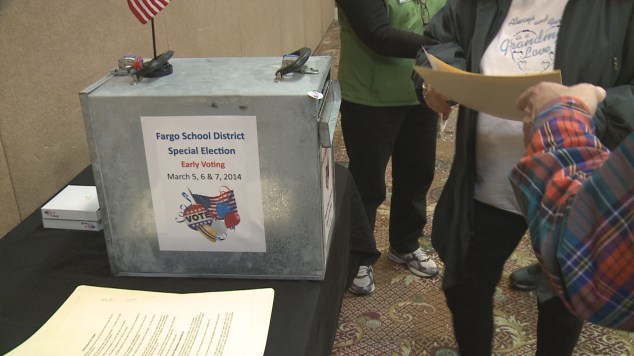

Last year the legislature passed a permanent property tax buy down, shifting a huge chunk of local school spending to the state budget. As a part of that deal, school districts are required to either cap their school mill levies at 70 mills or get approval from local voters to go higher. Voters in Fargo last night didn’t give that approval.

A couple of things jump out at me.

First, it seems to me like turnout was atrocious. Turnout is never very high for these local elections that aren’t part of a statewide ballot, but according to the Fargo Forum just 6,080 votes were cast. By comparison, the Fargo public school district has about 11,000 students. So not even one parent or guardian for every kid showed up to vote. Here in Minot, back in December, the school district held a vote on a bond issue and 8,696 ballots were cast (the bond failed). Fargo is a much bigger school district, with a much bigger population, but they had an even lower voter turnout.

That means a lot of voters were tuned out. Which brings me to my second point: Why Fargo citizens voted this down.

They could have been motivated by a desire for lower taxes. They could have been motivated by the feeling that Fargo Public Schools has more than enough funding already (there are examples of waste that could be mentioned here). And there could have been a feeling that the state will continue to gobble up local school spending.

That’s certainly the precedent. Since 2009 the state has bought down 125 mills worth of local school taxes. Paying for local schools is, traditionally, a local issue. But now that so much of the obligation for funding schools has shifted to the state through property tax buy downs, can you blame locals for thinking that any revenues they refuse to give themselves will be made up by a state government with deep pockets?

This is one of the side effects of the Hoeven/Dalrymple approach to property tax “relief.” Property tax buy-downs are creating the expectation of more buy-downs.

For better or worse, the state’s buy downs of property taxes have shifted issues like school funding away from a local political dynamic. Maybe Fargo voters felt they didn’t need to keep their local taxes so high with the state taking over school funding.

Update: A Fargo reader called me after this post and made some good points.

First, he pointed out that the schools “got a little cute” with the voting locations. After the last general election Fargo Public Schools voiced security concerns over using schools as polling places, but for this special election a lot of the polling locations were schools.

Second, he said local voters may be a little fed up with the school district which built a $46 million high school (the Davies High School) with no public vote, and then bought the Bluestem performing arts center which is widely seen as a financial boondoggle.