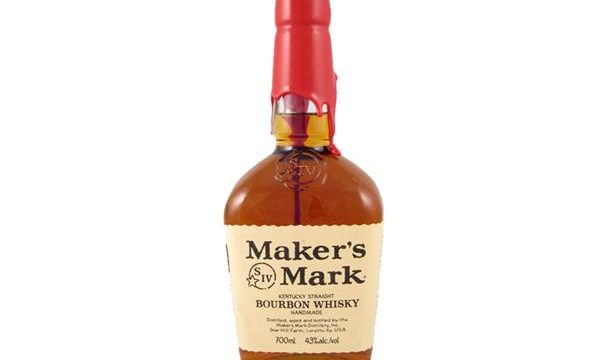

End Of The World: Maker's Mark To Water Down Its Bourbon

Many moons ago, I alerted a select group of Interweb Tube users to the onset of stealth inflation via the decreasing size or quality of products offered at the same price. There is a fancy-pants economic term for the this – hedonics – although I prefer less family-friendly terminology. Today comes word of a classic example of this stealth inflation, which is particularly unfortunate.

Maker’s Mark announced it is reducing the amount of alcohol in the spirit to keep pace with rapidly increasing consumer demand.

In an email to its fans, representatives of the brand said the entire bourbon category is “exploding” and demand for Maker’s Mark is growing even faster. Some customers have even reported empty shelves in their local stores, it said.

After looking at “all possible solutions,” the total alcohol by volume of Maker’s Mark is being reduced by 3 percent.

So, it will take you 3% more of the stuff to arrive at your particular preferred state of warm, bourbonized haze. All kidding aside, though, this is evidence of the inflation that your federal government says it can’t find any evidence of, which therefore gives it confidence to hold interest rates down for as far as the eye can see. Not only is the Fed flirting with danger according to a well-accepted economic theory of inflation, but they are also aiding and abetting fiscal recklessness, which could, according to a more controversial theory, bring about inflation.

As a result of the federal government’s enormous debt and deficits, substantial inflation could break out in America in the next few years. If people become convinced that our government will end up printing money to cover intractable deficits, they will see inflation in the future and so will try to get rid of dollars today — driving up the prices of goods, services, and eventually wages across the entire economy. This would amount to a “run” on the dollar.

Either way, it seems the risk of inflation is alarmingly high. Oh, and did I mention that inflation is very very bad?

The key reason serious inflation often accompanies serious economic difficulties is straightforward: Inflation is a form of sovereign default. Paying off bonds with currency that is worth half as much as it used to be is like defaulting on half of the debt. And sovereign default happens not in boom times but when economies and governments are in trouble.

If bond markets get spooked about inflation, the 40 cents or so on the dollar that we need to borrow to to sustain the Leviathan government they’ve built while we were sleeping will get very expensive to borrow. Also, many many people, from granny to pension funds all over the world, will lose alot alot alot of money. Last I checked, pension funds could not afford to lose any more money.