North Dakota Tax Revenue Growth Remains Strong, But No Longer Booming

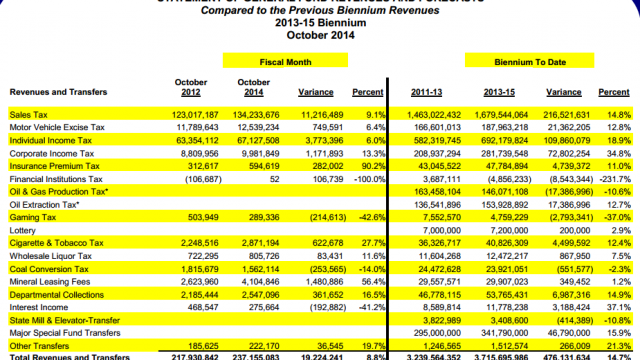

The latest revenue report is out from the Office of Management and Budget (see below), covering general fund revenues in the current biennium through October of this year.

So far revenues are nearly 15 percent – or more than $471 million than last biennium. The nearly $3.72 billion in general fund revenues the state has collected so far in the biennium is 10.5 percent, or about $354 million, more than was forecasted.

As you can see, the gap between forecasted revenues and actual revenues has been growing throughout the biennium:

Revenue growth has been strong in this biennium, but it’s pretty clear that we’re past the boom period. This chart shows biennium revenue to date for the current biennium compared to the last four. It’s honestly remarkable that the state has seen revenue growth on top of those monster 2011-2013 biennium numbers:

Take a look at that chart again. Current biennium general fund revenues are more than the state collected to this point in the 2009-2011 and 2011-2013 bienniums combined. And keep in mind, this is just general fund revenues. This doesn’t count all the revenues which flow directly into special accounts like the Legacy Fund, the Common Schools Trust Fund, etc.

(State Treasurer Kelly Schmidt has a great summary of the state’s various funds on her website)

This is why it was misleading when Governor Jack Dalrymple, during his recent budget address (video here), tryied to tamp-down concerns over falling oil prices by claiming that the general funds take of oil and gas taxes is capped at $300 million per biennium. He’s right, of course, but it’s clear that the oil boom has an impact on general fund revenues which goes far beyond direct oil/gas taxes.

For instance, sales tax revenues to date in the current biennium are more than double what they were in the 2009-2011 biennium. That’s the oil boom at work.

Which brings us to the big question: How long will double-digit increases in general fund revenues continue? As we can see, they’ve already begun to slow down, but even if we reach the point where there’s no revenue growth at all the state will still be collecting multiples of what it did in past bienniums.