North Dakota General Fund Revenues Up Nearly 20 Percent So Far In Biennium

North Dakota’s general fund revenues continue their stunning rate of growth according to the latest monthly from the Office of Management and Budget (see the full update below).

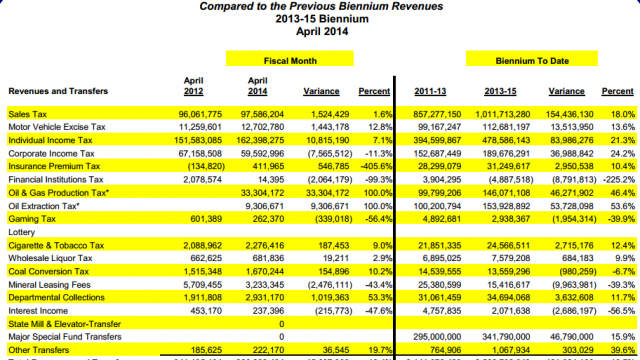

So far in the 2013-2015 biennium the state has collected over $2.562 billion in general fund revenues, which is 19.7 percent or $421 million more than the state collected at this point in the last biennium.

Oil tax revenues continue to come in faster than expected. The state has hit its cap on oil tax revenues for the general fund, which is months earlier than projected. “The original forecast assumed that cap would not be reached until July 2014,” reads the report. “No additional oil taxes will be deposited in the general fund during the 2013-15 biennium.”

Income tax revenues continue to be a remarkable story as well.

In 2008, voters defeated a ballot measure backed by the state chapter of Americans for Prosperity, which would have reduced state income tax rates by 50 percent, and corporate income tax rates by 15 percent. But starting in 2009, legislators have, in successive sessions, implemented a series of more modest cuts that have reduced corporate and personal income tax to below where the 2008 measure would have set them.

Despite the reductions, income tax revenues have boomed. Individual income tax revenues are up 21.3 percent and corporate income tax revenues are up over 24 percent.

The revenue projection, which has been wildly inaccurate in previous bienniums leading to complaints from some who argue that the Legislature could spend more (or tax less) if we had accurate revenue forecasts, seems to be much more accurate this time around. Last biennium the forecast was off by 49 percent, or more than $1 billion.

So far in the current biennium revenues are coming in about 9 percent ahead of the forecast, amounting to a little over $208 million. Still not good, but a lot better.

Here’s a graph comparing this biennium’s cumulative general fund revenues compared to the previous three bienniums.

That 20 percent increase in general fund revenues looks all the more impressive when you consider that it’s coming on top of a simply unbelievable rate of revenue growth in the 2011-2013 biennium. At this point in the last biennium revenues were up 60%. So that 20% figure is on top of a 60% increase from April of 2012.