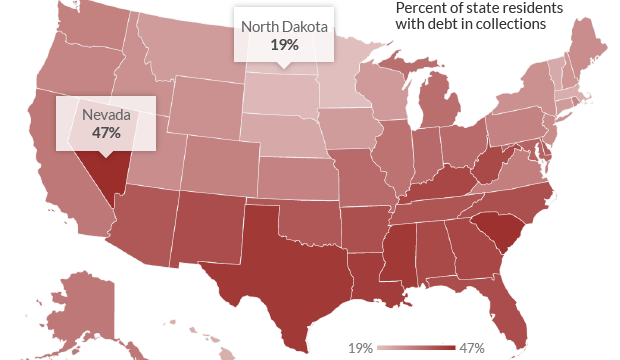

North Dakota Has Least Number Of People With Debt In Collections

According to this study from the Urban Institute, one in three Americans are being sought by debt collectors.

That’s an astonishing number.

Mortgage debt was excluded from the study, which included things like credit cards, car loans, medical bills, child support, and parking tickets. The average debt being sought is about $5,200.

Not surprisingly, though, North Dakota has the smallest percentage of the population with debt in collections:

Among the states, Nevada had the highest percentage of residents with debt in collections — 47% – as well as the highest average amount owed – $7,198. That was helped in part by the Las Vegas metro area, where 49% of residents had debt in collections.

By contrast, North Dakota had the lowest percentage of residents with debt in collections at just 19%, while the District of Columbia had the lowest average dollar amount owed per person at $3,547.

Not surprising in the state that has lead the nation in personal income growth in 6 out of the last 7 years.

I suspect, after years of a booming economy driven by energy development and strong crop prices, North Dakotans have probably paid off a lot of debt.

Nationally, though, what an ugly picture. And even North Dakota’s percentage works out to about one in five people with debt in collections. That’s still a lot.

But, hey, let’s raise the minimum wage or something. I’m sure inflating the cost of labor will totally put Americans back to work.